The structure and function of a PET/CT installation

What goes into getting into the PET/CT business? Robert Brait, the PET/CT product manager at Siemens Healthcare in Malvern, Pa., runs through a typical installation.

Tue May 01 2012

The structure and function of a PET/CT installation

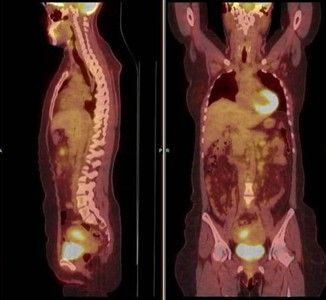

Double Image

Though not a new technology, PET/CT remains a go-to diagnostic tool for a variety of treatment specialties, from oncology to cardiology to neurology. Physicians are finding ever-more applications for the technology, particularly in interventional radiology. Hospitals and health centers have realized myriad benefits of investing in the dual-modality machine, which allows physicians to record images of both bodily structure and function.

What goes into getting into the PET/CT business? Robert Brait, the PET/CT product manager at Siemens Healthcare in Malvern, Pa., runs through a typical installation.

GET IT IN WRITING – AND OTHER REQUIREMENTS

The first thing any facility will need in its quest for a PET/CT is a certificate of need (sometimes called a document of need)—even before a purchaser may determine its qualification and need.

Typically, this includes the report from an oncological referrer – either a center of excellence or a tumor board. On the strength of those recommendations, a health center can then qualify for a certificate of need, says Brait, the issuance of which is determined by the state in just under half the country.

“It varies state by state,” Brait says. “In some, it requires you to have a mobile unit and demonstrate for at least a year that you can do 1,200 patients in a year for a mobile unit before you can get a fixed site. Are you able to do a minimum of X number a day? Then, they’re going to say, ‘Show us your tumor board data that suggests you’re seeing enough patients to require a PET/CT scan.’” This is to determine the need for PET imaging service in a community, based on cancer incidence.

“There will probably be more scrutiny if the Affordable Care Act is upheld,” Brait says. “The government has given guidelines out where they’re going to measure sites based on their utilization; how they’re going to provide this service, whether it’s a shared service, if it’s going to be used 75 to 85 percent of the time throughout the day to get complete reimbursement.”

“I’m sure that’s how hospitals and imaging centers are looking at this,” he says. “‘How can I use it in the best possible way—fixed site, modular or mobile service?’”

Typically, Brait says, the minimum required throughput is three patients a day. Traditional scan times vary from 45 minutes to an hour, though new technology has shortened that duration. With the exception of a melanoma scan, which requires a full-body study, Brait says a premium Siemens system can produce a whole-body PET/CT image in anywhere from five to 20 minutes, depending on how the scanner is equipped.

Not every cancer patient will need a PET/CT scan; in fact, existing clinical algorithms require that patients undergo a CT before they can qualify for a PET/CT. In years to come, Brait says, that might change: PET/CT shows not only the location of the disease, but also its functionality.

“You may be able to determine that the patient takes up the biomarker in a very avid form, so now we measure that lesion and determine what the avidity is for that radioactive biomarker,” he says. “You want to be able to know that the disease you are illustrating can be more specifically treated. Some cancers respond better to chemo, others to radiation; others require both.”

Again, says Brait, any site that would make use of such biomarkers when performing a PET/CT must also have a radiation license to possess and use these biomarkers, which is often issued through the state department of health or the Nuclear Regulatory Commission.

Selecting a physical site for a PET/ CT scanner can vary depending upon the type of unit being purchased. For a fixed installation of a Siemens scanner, a room that measures 16 feet by 26 feet will usually suffice. In terms of technical requirements, the space must be able to access chilled water or a chiller, and a hot lab, which will house the radioactive biomarkers. The room will require lead shielding to contain the ionizing radiation from the scanner and the biomarkers. As Brait points out, fluorine has a much stronger radiation than SPECT isotope products, and therefore requires greater shielding.

“People have moved to rubidium, which has its own problems as a biomarker, which is why people are looking for a fluorine-based technology,” Brait says. “You would have

to figure out if you have access to the isotopes.”

He points out that PETNET, a Siemens company, has access to 46 distribution centers with rubidium. Without a distribution chain or a stable supply, facilities must have access to a generator that can extract it. Even renting one in a part-ownership stake will cost about $37,000 per month, he says.

“Unless you have a very strong cardiology practice and those patients that would require rubidium imaging, it’s too expensive,” Brait says. “They only use it one day a week.”

A PET/CT installation also requires a waiting and receiving area, as well as a quiet room where patients receive the isotope injections. The room must be totally free of distractions and allow the patient to remain still for at least 60 minutes so the biomarker can distribute properly. Even something as simple as listening to music or watching television could cause the chemical to flood to the wrong area of the brain or body instead of illuminating the area of interest, Brait says.

Rounding out the physical plant of a PET/CT build is a small room for electronics, “for some of the computer stacking that takes place to drive the equipment,” Brait says.

“You’re going to have a control booth, which is usually in the scanner room but which is shielded for the technologists,” he says. “You’re going to have a bank of computers that drive the machine and can be deposited there.”

In addition to fixed installations, Brait says, some sites select modular PET/CT units; others still acquire mobile units. Some rural areas, for example, serve multiple sites from a single mobile provider; these also often combine patient numbers at those sites to aggregate usage for the permitting process. They may even use these numbers to drive approval of a fixed unit at one specific site.

“We’re one of the only companies that has scalable, upgradable features to our products,” Brait says.

“We designed our main key features as well as our product groups to upgrade to different numbers of slices; we also have the same thing on our PET side, where they come standard with three detector rings and you can buy a fourth in the field.”

Siemens represents 42 percent of the market share of PET/CT in the country, says Brait. He says the current market for PET/CT has been declining over the last 36 months, which is affecting business strategy at all major vendors...

To read this complete article click HERE.